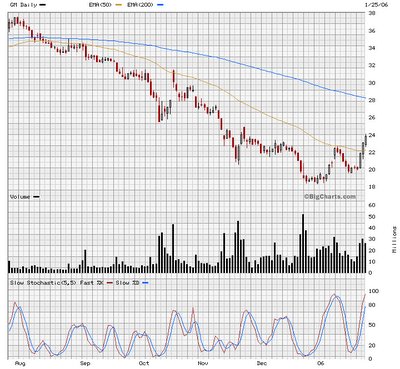

Hpq. A good buy at the fifty-day moving average (blue line). Continuation of the uptrend with support at forty. They must like this Hurd guy.

...For now, folks may actually think that the Fed will fight inflation. So, days like last Wednesday lead to "Fed's gonna be tough" talk. Which is why metals can go down in a session when inflation fears are running on the high side.

Setup for metals' gain, stocks' pain

Nevertheless, as the vise tightens down the road -- i.e., inflation is still not under control, but the economy is clearly slowing down -- you can be sure that the Fed will opt for rationalizing inflation, in the (futile) hope of not presiding over a nasty downturn. That will be the moment in time when the metals (and foreign currencies) really go wild to the upside.

Meanwhile, I believe that the path of least resistance for equities will now be down in the short run. And when we get the next rally, I would expect it to fail, since I firmly believe that the top of this three-year-long bear-market rally has finally been seen.

"With the Asian markets all slumping, recent bearish sentiment, which initially began with caution over more (possible) U.S. rate hikes, has gotten worse and worse," said Samsung Securities analyst You Sung-min. "The (BOK) rate hike was just one more on top of layers of negative factors."

South Korean banks were hit hard by the rate hike, fueling worries of a possible cooldown in South Korea's sizzling property market and concern over whether the economy is strong enough to sustain higher borrowing costs.

The losses came after stocks dropped on Wall Street Wednesday, extending investors' losses for a third straight session and pushing the Dow Jones industrial average below 11,000 for the first time since March 9.

NEW YORK (Reuters) - The member-owned American Stock Exchange said on Thursday it intends to convert into a for-profit corporation and likely move toward an initial public offering -- becoming the latest exchange to revamp its structure as investor demand for the sector heats up.

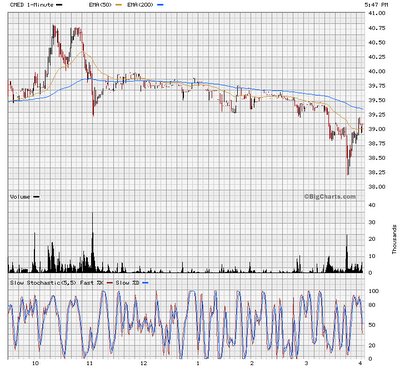

CHICAGO, March 23 (Reuters) - The shares of two high-flying financial exchanges, International Securities Exchange Inc. (ISE.N: Quote, Profile, Research) and CBOT Holdings Inc. (BOT.N: Quote, Profile, Research), plunged on Thursday in profit-taking and worries about competition.

ISE, the largest U.S. equity options mart, led the way as it continued a steep decline from its March 15 high of $52.84.

But CBOT finished as the day's biggest loser on the New York Stock Exchange after analysts at Jefferies & Co. said some profit-taking should not come as a surprise for the parent of the No. 2 U.S. futures mart.

"Consolidations and alliances among our current competitors may create larger liquidity pools than we offer. The resulting larger liquidity pools may attract orders away from us, leading to a decline in our trading volumes and liquidity, which would lead to decreased revenues," ISE said.

ISE also said that, with other exchanges now running hybrid open-outcry/electronic trading systems, "certain qualities of our market are becoming more common."

As competitors improve their market quality, "commoditization of electronic trading in the options industry may begin, which could lead to an increase in price competition," the company said.

According to the most recent monthly report from the World Federation of Exchanges, the NYSE and Nasdaq combined had $16.9 trillion out of the world's $41 trillion in stock market capitalization in December 2005, or 41.2 percent of the world's total. That's impressive. But it's down sharply from January 2001, when the NYSE and Nasdaq combined held 48.4 percent of the world's stock market capitalization.

This was the third bid received by the LSE in 15 months and its rejection of Nasdaq's offer fueled speculation it might not be the last, with the New York Stock Exchange -- the world's largest stock exchange and Nasdaq's arch rival -- rumored as a potential buyer.

Nasdaq's approach comes just two days after the NYSE Group Inc. (NYSE:NYX - News), owner of the Big Board, went public by sealing its purchase of electronic rival Archipelago Holdings.

But Repetto expects the NYSE to come up with a rival offer and thinks that among U.S. players the Chicago Mercantile Exchange Holdings Inc. (NYSE:CME - News) could be a "longshot" to put in an offer.These newly public companies now have a pile of cash and their own stock, with which to buy other exchanges and catch their competition napping.

Margaret Nagle, a spokeswoman for Archipelago, said the Pacific's electronic option-trading, which now uses a system called PCX Plus, will change to an entirely new electronic trading platform in the middle of this year, to be based on Archipelago's technology. "The new platform that we're rolling out includes there being a physical (trading) floor," she said.

In response to conjecture that the trading floor might close this year, she said: "I know nothing of any plans of it being phased out in the near future, meaning anytime this year. That would be news to me. My understanding was that the floor, I can't say will remain in place in perpetuity, but there are no plans to phase it out this year."

Thain has expressed confidence in the hybrid program and appears to be poised to take advantage of the exchange's newfound independence from its seat holders. The former Goldman Sachs president hopes to expand the NYSE's offerings to include derivatives trading, including equity options side-by-side with sales of the stocks themselves, as well as corporate bond trading.

In the future, it's possible that floor traders could not only trade NYSE-listed stocks, but also those listed on the Nasdaq. With NYSE-listed stocks already electronically traded on Nasdaq, as well as Archipelago, the NYSE could not only retain some of its own market share, but also eat into Nasdaq's.

Thain has also said he is still considering expanding the NYSE's operating hours in order to compete with European markets, though that has run into some resistance from traders on the West Coast, who are already in the office at 6:30 a.m. Pacific time for the opening bell.

Alternatively, the NYSE could go after the Chicago Board of Options Exchange or the International Securities Exchange in order to get a bigger piece of the options and derivatives trade.

"China's foreign exchange reserve hit 818.9 billion dollars at the end of last year but what China really needs should be no more than 250 billion dollars," economist Xiao Zhuoji told the Shanghai Securities Times.

"The current (holdings are) way above actual needs," he said.

Chinese reserves should be cut by more than two-thirds from current levels, said Xiao, who is also a member of the Chinese People's Political Consultative Conference (CPPCC), an advisory body to the government.

Silver prices moved above $10 a troy ounce for the first in more than 22 years buoyed by strong buying in metal and energy markets.

Traders said investors were also buying into the metal in the hope of a favourable US regulatory ruling on the launch of a proposed silver-backed exchange traded fund. Barclays Global Investors has filed with the Securities and Exchange Commission to list a silver backed ETF, which potentially opens up the silver market to new investors.

Behind the glowing headlines are fundamental frailties rooted in the Chinese neo-Leninist state. Unlike Maoism, neo-Leninism blends one-party rule and state control of key sectors of the economy with partial market reforms and an end to self-imposed isolation from the world economy. The Maoist state preached egalitarianism and relied on the loyalty of workers and peasants. The neo-Leninist state practices elitism, draws its support from technocrats, the military, and the police, and co-opts new social elites (professionals and private entrepreneurs) and foreign capital—all vilified under Maoism. Neo-Leninism has rendered the ruling Chinese Communist Party more resilient but has also generated self-destructive forces.

But China’s tentacles are even more securely wrapped around the economy than these figures suggest. First, Beijing continues to own the bulk of capital. In 2003, the state controlled $1.2 trillion worth of capital stock, or 56 percent of the country’s fixed industrial assets. Second, the state remains, as befits a quintessentially Leninist regime, securely in control of the “commanding heights” of the economy: It is either a monopolist or a dominant player in the most important sectors, including financial services, banking, telecommunications, energy, steel, automobiles, natural resources, and transportation. It protects its monopoly profits in these sectors by blocking private domestic firms and foreign companies from entering the market (although in a few sectors, such as steel, telecom, and automobiles, there is competition among state firms). Third, the government maintains tight control over most investment projects through the power to issue long-term bank credit and grant land-use rights.

China’s business cycle is therefore driven by Beijing. Private-sector firms have very limited access to finance or new markets. The state even dominates many ostensibly deregulated sectors, such as the brewing industry, the retail sector, and textiles. Of the 66 publicly traded retailers in the country, only one is private. There are only 40 private firms among the 1,520 Chinese companies listed on domestic and foreign exchanges.

While in the Fed-words-in-lieu-of-action department, I heard from a knowledgeable friend who expressed surprise "that Ben expects investors to hold firm to the concept that 12%-plus growth in short-term credit and 8%-plus growth of M3 is evidence that the Fed has reined in its past accommodations." The Fed has, of course, not reined in its past accommodations, and, in my opinion, has no intention of doing so.

For the moment, though, some folks seem to think the Fed is actually tight and inclined to be tighter -- a notion that I find almost laughable.

“If you ask me again in three years time, I would say that the size of the market will have doubled again,” said Mr de Vitry.

Now, since it is not possible to quantitatively establish the status of the total of real goods and services, obviously various data like real income, real personal consumption expenditure, or real GDP that government statisticians generate shouldn't be taken too seriously. The data that are generated by means of mathematical methods is just a fiction.

Yet this fiction passes as the facts of reality, which allows economists to make comments with a straight face regarding the likely future direction of the real economy. The debate is often confined to the decimal point of the rate of growth. Thus it is debated whether the economy will grow by 3.1% or by 3.5%.

The fictitious data are served as a benchmark against which various economic theories are validated. Also, once it is accepted that it is "possible" to quantify the state of the real economy then one can also establish another fiction — the price level. This in turn provides the rationale for the importance of keeping the price level stable. And this in turn provides the justification that the central bank ought to navigate the economy towards the path of stable price level and stable real economic growth.

About $250 billion of China's reserves are in U.S. Treasuries. China's purchases ``put Pimco's Bill Gross to shame and contribute to low yields'' in the world's biggest economy, said Nouriel Roubini...

The press tends to hyperventilate over Gross's frequent comments about U.S. debt yields. The reason: He manages Newport Beach, California-based Pacific Investment Management Co.'s $90.6 billion Total Return Fund. Investors might be wise to pay more attention to where the really big money is: in Beijing.

Asia's currency-reserve arms race reflects two things. First, a desire to keep currencies from rising so that exports aren't hurt. Second, a determination to avoid a replay of 1997, when the region lacked ample reserves to fight speculators attacking currencies.

Costs of intermediate goods, those used in earlier stages of production, rose 1.2 percent last month and are up 9.3 percent in the 12 months ended in January. Prices of raw materials, or so- called crude goods, fell 0.5 percent and were up 23.6 percent in the last 12 months.

Faced with rising raw-material costs, manufacturers are raising prices. Caterpillar Inc., the world's largest maker of earthmoving equipment, said last month that fourth-quarter profit surged 54 percent, helped in part by higher prices. The company raised its earnings forecast for this year and announced a price increase of as much as 5 percent, effective Jan. 1.

Broad money supply (M3) rose $9.3 billion to a record $10.280 Trillion (week of Feb. 6). During the past 38 weeks, M3 has inflated $654 billion, or 9.3% annualized. Over 52 weeks, M3 has expanded 8.2%, with M3-less Money Funds up 8.3%. For the week, Currency added $0.4 billion. Demand & Checkable Deposits fell $26.4 billion. Savings Deposits jumped $24.2 billion, and Small Denominated Deposits increased $2.6 billion. Retail Money Fund deposits slipped $0.6 billion, while Institutional Money Fund deposits rose $11.0 billion. Large Denominated Deposits declined $11.0 billion. Over the past 52 weeks, Large Deposits were up $264 billion, or 23.3% annualized. For the week, Repurchase Agreements jumped $12.6 billion. Eurodollar deposits declined $3.5 billion.

Bank Credit gained $2.8 billion last week (5-wk gain of $103bn) to a record $7.591 Trillion. Over the past 52 weeks, Bank Credit has inflated $676 billion, or 9.8%. For the week, Securities Credit declined $6.1 billion. Loans & Leases were up 12.0% over the past 52 weeks, with Commercial & Industrial (C&I) Loans up 15.3%. For the week, C&I loans declined $3.6 billion, while Real Estate loans expanded $8.9 billion. Real Estate loans have expanded at a 10.9% pace over the past 20 weeks and 14.5% during the past 52 weeks. For the week, Consumer loans were about unchanged, and Securities loans increased $7.6 billion. Other loans declined $4.3 billion.

Total Commercial Paper dropped $14.5 billion last week to $1.675 Trillion. Total CP is up $25.4 billion y-t-d (7wks), while having expanded $241 billion over the past 52 weeks, or 16.8%. Last week, Financial Sector CP borrowings declined $13.5 billion to $1.537 Trillion, with a 52-week gain of $247 billion, or 19.2%. Non-financial CP declined $1.0 billion to $137.7 billion, with a 52-week decline of 4.0%.

Economists since Adam Smith have argued that competition in production serves consumers' interests, while monopolies tend toward sloth and waste. Gustave de Molinari, editor of the Journal des economistes, was probably the first legal theorist who dared to ask why this should not be as true of the law as it is of apples, cotton, and iron. He argued that under the state's monopoly of law " Justice becomes slow and costly, the police vexatious, individual liberty is no longer respected, [and] the price of security is abusively inflated and inequitably apportioned. . . ." He therefore advocated a non- monopolistic legal system and projected that once " all artificial obstacles to the free action of the natural laws that govern the economic world have disappeared, the situation of the various members of society will become the best possible."

Our analysis doesn't imply that the US economy is in healthy shape - far from it. However, what we maintain is that the key factor behind the erosion of US fundamentals is not the widening in the trade account as such, but rather the policies of the Fed. During the reign of Alan Greenspan between August 1987 and December 2005, money AMS has increased by 173%. Greenspan's strong monetary pumping was accompanied by a massive artificial lowering of interest rates. The federal funds rate was lowered from 6.5% in 2000 to 1% in 2003. Obviously then such reckless policies must have severely undermined the process of real wealth formation. However, focusing on the trade account statements only diverts the focus of attention from the true culprit behind the erosion of US economic fundamentals.

The index "will provide an essential composite look at this new market, and will provide the benchmark that investors and analysts will use as the indicator for this emerging business sector," said CBOE Chairman and CEO William Brodsky in a statement. He expects options and futures to be listed on the index soon.

As an exercise for the students, compare and contrast the results from raising a boring quarter point now and another quarter point at the next meeting, versus a bold half point increase now and no increase at the next meeting. The following Fed meetings will show the timing value of a sharp increase in rates now. By then, the media will talk about little more than the dreaded deflation toward which our economy is surely falling, and the Fed will be able to cut rates by a half point at each of the next few meetings to protect us from the dastardly deflation fate which would otherwise crush our economy (despite the contrary evidence offered by energy and metals prices which will be setting new record highs). Those sharp rate cuts over the spring and summer, combined with the ever increasing M3 money supply which will no longer be published, will have our economy running at full speed again by late fall, and will push stock prices to record highs. Coincidentally, that will put voters in a good mood by November.

His latest move may indicate he believes GM is listening to his ideas for improving the company. In a speech to Wall Street analysts this month, Kerkorian's top aide Jerome York called on GM to cut its annual dividend in half and set profitability goals and a timetable for achieving them.

York said Kerkorian was interested in buying more GM shares and was optimistic about its recovery efforts, but he said it was time for GM to get into a "crisis mode."

Economists estimate that more that 70 per cent of the reserves are invested in US dollar assets, which has helped to sustain the recent large US deficits. If China were to stop acquiring such a large proportion of dollars with its reserves - currently accumulating at about $15bn (EU12.4bn) a month - it could put heavy downward pressure on the greenback.

However, according to Stephen Green, economist for Standard Chartered in Shanghai, although the language was "vague", Thursday's statement was the first time Safe has publicly indicated a shift away from dollar assets.

"It is a subtle but clear signal that they are interested in moving away from the US dollar into other currencies, and are interested in setting up some kind of strategic commodity fund, maybe just for oil, but maybe for other commodities," he said.

"The People's Bank of China plans to restrict growth in M2, the broadest measure of money supply, to 16 percent this year, the central bank said on its Web site, citing an annual working conference held yesterday."

``The M2 target is in line with the aim of having a healthy and stable policy,'' said Huang Yiping, Citigroup Inc.'s Hong Kong-based chief Asia economist.

``The M2 target is in line with the aim of having a healthy and stable policy,'' said Huang Yiping, Citigroup Inc.'s Hong Kong-based chief Asia economist. ``We aren't expecting any big tightening moves until inflation picks up and becomes a risk.''

China's consumer prices rose 1.3 percent from a year earlier in November, compared with a 1.2 percent gain in October. Inflation has eased from a high of 5.3 percent in July and August 2004 after the government clamped down on bank lending to industries such as steel and real estate.

The number of rate increases needed to control inflation ``probably would not be large,'' yesterday's minutes from the Fed's December policy meeting showed. The ``measured'' phrasing was retained to avoid any suggestion of bigger rate increases, the central bank said.