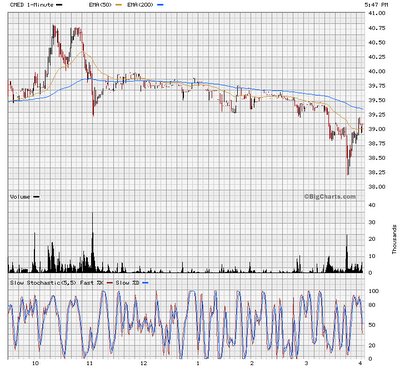

Look at the Chicago Mercantile Exchange, CME. After forming an eight week base on top of a long run up, it still has the strength to break out to new highs above $400.

The Chicago Board of Trade, BOT, an IPO from last year is also doing well. The quick money is gone. It may now be in stronger hands and under accumulation. Yahoo Finance shows that The Vanguard group is the only significant holder but a few other big funds have started to take positions at the end of last year.

Both the Arca Exchange, AX, and the Nasdaq, NDAQ, have shown big volume rallies off of their moving average supports with similar chart patterns.

AX of course owns the Pacific Exchange and is merging with the NYSE.

Do you want a link to most of the exchanges around the world? I found a pretty good one here.

This stodgy old industry is becoming more dynamic as new technology forces its way in, and those who refuse to innovate, get bought out or die.

Competition from abroad forces regulatory changes in the United States and elsewhere that never would have occured without it. Those who benefited from the lack of competition in the past would have watched their order flow dwindle down to a trickle.

The Self Regulated Organization, SRO, model is a failure. A P&L is crucial in decision making. It forces institutions to serve real people, and rewards the best for doing so efficiently.

This is an industry that is slowly being released from its bureaucratic bondage, into a world where it has more to gain from tech innovation than any other. These firms will come to realize that they are nothing more than networks.

An exchange used to be defined by its location. But no longer. The concept of an exchange is being released from its earthly location. If the Pacific exchange abandons it's trading floor in San Francisco and goes virtual with all of its market makers participating electronically, is it still the PCX? The customer may not even notice a change.

...and you are holding IBM in your IRA?

Genius.