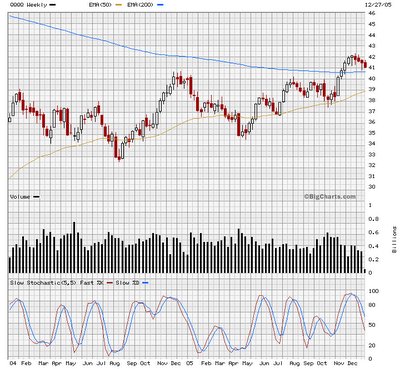

Using the qqqq as a proxy for the stock market, here is a two-year weekly chart showing the nasty fall the market took at the beginning of last year; dropping about 1/8th of its value in the first three months of the year and then using the Spring and the Fall to recover.

$40 has been the key level during this period for the q's, providing resistance to the upside, and will also provide support, when the stock starts to break lower.

This last end-of-the-year rally has been low on volume, and looks to be running out of steam. The return to the $40 level for a test will not be far off.

Short rates have risen and may continue to do so as the Fed attempts to fight the very real threat of rising prices, i.e. "domestic dollar devaluation"; a problem which was created, of course, by the Fed itself.

The yield curve has inverted, increasing the odds of a recession next year. An inverted yield curve simply means that it no longer pays banks and other financial institutions to do what they do: borrow short term money to lend it long term. It's selling something for less than you buy it for, over and over again.

When lending is unprofitable, the boss hits you over the head and tells you to knock it off. So all sorts of productive activity doesn't get financed and that means it doesn't happen. Business slows. Bubbles burst. people feel poorer.

What could prevent a recession from happening next year?

The always easiest answer is that the Fed could return to her old ways and start pumping it out again like the drunken prom queen she is. Stop kidding us honey, you know you love it!

Another very real possibility is that some kind of tax reduction legislation gets pushed through sparking another growth cycle with an unexpectedly big market upside.

The establishment fears deflation like a liberal fears virginity; odds are, they'll do whatever it takes...

No comments:

Post a Comment