Motorola looks great with strong volume on the up days, a convincing break above its 200 day moving average, and a methodical base building process as it approaches the break out point at $24. It would be best if it had one more shake out to form a handle, before the big volume break out to new highs.

St. Jude Medical is also in an orderly uptrend, with the big volume days on the upside. It is one of the leading stocks in the strong medical sector and is showing good action after its break out at $47 1/2. A break above $50 with the continued support of its 50 day average could leave this stock a longer-term winner.

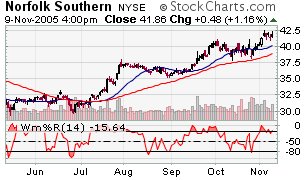

Norfolk Southern is in the very strong transports sector, has broken above a short-term base at $41, and shows the signs of volume accumulation and support in the moving averages.

The big caps tend to be less volatile, have a lot of liquidity, and have very active options markets behind them, leaving many ways to gain from their movements.

Now go forth and prosper.

No comments:

Post a Comment