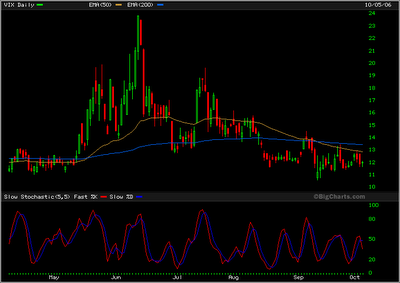

Hey volatility is low as the market continues to rally, and it will stay low as long as stocks rise. But will it go much lower than this? Probably not.

With vol low, options prices--both calls and puts--are cheap. So making directional bets on a stock by buying options, is less expensive than normal.

Betting on the downside by buying puts has the added benefit that when stocks go down, implied volatility goes up, kicking up the prices of the puts higher than you would've expected. So if the rally has given you some profits to protect, consider buying the puts to hedge.

October can be full of nasty surprises.

Let that be the other guy's problem.